Proof of Work vs. Proof of Stake: The Future’s Best Choice

In the realm of blockchain technology, consensus mechanisms play a pivotal role in ensuring the integrity and security of decentralized networks. Among the most prominent of these mechanisms are Proof of Work (PoW) and Proof of Stake (PoS). Both serve the fundamental purpose of validating transactions and adding new blocks to the blockchain, yet they […]

Creating Your Own Financial Plan: No Advisor Needed

Establishing clear financial goals is the cornerstone of effective financial planning. These goals serve as a roadmap, guiding your decisions and actions toward achieving your desired financial future. Financial goals can be broadly categorized into short-term, medium-term, and long-term objectives. Short-term goals might include saving for a vacation or paying off a small debt, while […]

Finding the Right Budgeting Method: 50/30/20 Rule vs. Zero-Based Budgeting

The 50/30/20 rule is a straightforward budgeting framework that allocates an individual’s after-tax income into three distinct categories: needs, wants, and savings or debt repayment. The premise is simple yet effective: 50% of your income should be dedicated to essential needs, such as housing, utilities, groceries, and transportation. These are the non-negotiable expenses that one […]

Understanding Target-Date Funds: Who Should Invest?

Target-date funds (TDFs) are a type of investment vehicle designed to simplify the retirement planning process for investors. These funds are structured to automatically adjust their asset allocation over time, becoming more conservative as the target date approaches, which is typically aligned with the investor’s expected retirement date. For instance, a target-date fund with a […]

Green Investing: Future Outlook

In recent years, green investing has emerged as a significant trend within the financial markets, driven by a growing awareness of environmental issues and the urgent need for sustainable development. This investment approach focuses on allocating capital to projects and companies that prioritize environmental sustainability, social responsibility, and ethical governance. The rise of green investing […]

Investing in Sovereign Gold Bonds: Smart Strategies

Sovereign Gold Bonds (SGBs) are government securities denominated in grams of gold, issued by the Reserve Bank of India (RBI) on behalf of the Government of India. Launched in November 2015, these bonds were introduced as a means to reduce the demand for physical gold, which has historically been a significant part of Indian culture […]

Renovate Your Home Wisely with a Personal Loan

Personal loans have emerged as a popular financing option for homeowners looking to undertake renovation projects. Unlike home equity loans or lines of credit, personal loans are unsecured, meaning they do not require the borrower to put up collateral, such as their home. This characteristic makes personal loans particularly appealing for those who may not […]

Understanding Insider Trading: Why It’s Illegal

Insider trading refers to the buying or selling of a publicly-traded company’s stock based on material, non-public information about that company. This practice can occur when individuals with privileged access to confidential information, such as executives, board members, or employees, make trades that could yield significant profits or avoid losses. For instance, if a CEO […]

Demystifying Stock Splits: Impact on Your Portfolio

A stock split is a corporate action in which a company divides its existing shares into multiple new shares to boost the liquidity of the shares. This process does not change the overall market capitalization of the company; rather, it simply increases the number of shares outstanding while proportionally reducing the share price. For instance, […]

Mastering Demat Accounts: Pro Tips

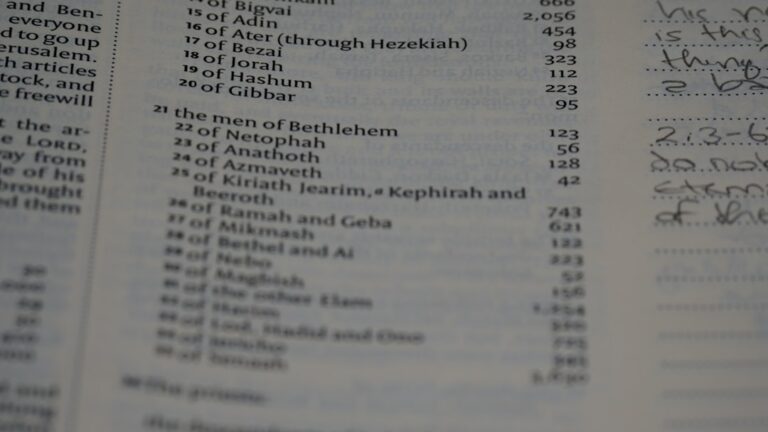

A Demat account, short for “dematerialized account,” serves as a digital repository for holding securities such as stocks, bonds, and mutual funds in an electronic format. This system was introduced in India in 1996 to facilitate the trading of securities without the need for physical certificates, which were often cumbersome and prone to loss or […]