Understanding how your money grows over time is a cornerstone of financial literacy. Whether you are saving for retirement, a home, or your children’s education, the method by which your investments accumulate can have a profound impact on your financial future. At the heart of this concept lies the distinction between simple interest and compound […]

The Rise of Proprietary Trading: How Funded Accounts are Transforming Traders’ Careers

Proprietary trading, commonly known as prop trading, has rapidly evolved into a popular pathway for traders seeking bigger opportunities without the burden of risking their personal capital. For those eager to break into professional trading, understanding the new dynamics of the prop trading world is essential. This article explores the rise of funded accounts, the […]

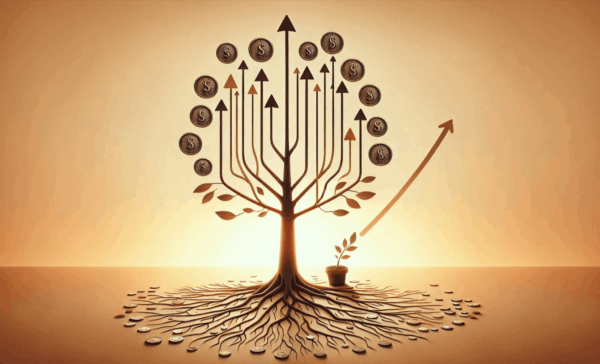

How does revenue-based financing work for start-ups

This article will discuss the workings of revenue-based financing, how it became a popular choice, and what every startup should know before opting for this funding model. Starting a business is exciting. However, most early-stage startups do not have the funds for such growth and turn to traditional channels, such as bank funding or venture […]

Creating Your Own Financial Plan: No Advisor Needed

Establishing clear financial goals is the cornerstone of effective financial planning. These goals serve as a roadmap, guiding your decisions and actions toward achieving your desired financial future. Financial goals can be broadly categorized into short-term, medium-term, and long-term objectives. Short-term goals might include saving for a vacation or paying off a small debt, while […]

Finding the Right Budgeting Method: 50/30/20 Rule vs. Zero-Based Budgeting

The 50/30/20 rule is a straightforward budgeting framework that allocates an individual’s after-tax income into three distinct categories: needs, wants, and savings or debt repayment. The premise is simple yet effective: 50% of your income should be dedicated to essential needs, such as housing, utilities, groceries, and transportation. These are the non-negotiable expenses that one […]

Preparing for a Financial Emergency: Loan-Free Strategies

Emergency funds serve as a financial safety net, providing individuals and families with the necessary resources to navigate unexpected expenses without derailing their financial stability. These funds are crucial for covering unforeseen costs such as medical emergencies, car repairs, or sudden job loss. The significance of having an emergency fund cannot be overstated; it acts […]